When it comes to investing, I like to keep things simple. I understand that the majority of people don’t have a lot of time to dedicate to their finances and so it’s important, in my opinion, to follow some key fundamentals. These include:

– Finding quality investment products that you understand and are comfortable with.

– Finding strong investments that can offer solid rates of return.

– Growing your wealth through regular contributions.

– Preserving your wealth when you start to draw on it through retirement.

– Finding an advisor that you trust and feel comfortable with to help you with your investment goals.

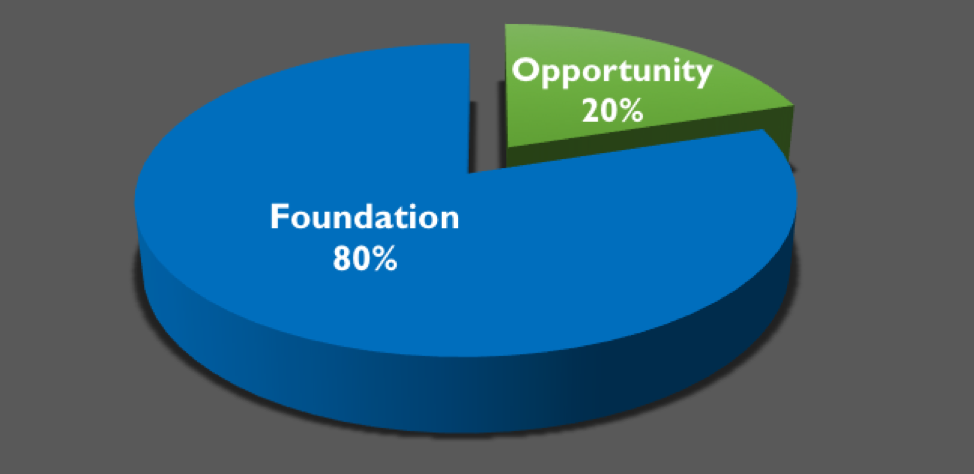

THE 80/20 PORTFOLIO

When I first meet with clients, I generally start out with an 80/20 approach to investing. With 80% being the Foundation of your portfolio and 20% being the Opportunity portion of your portfolio.

When I first meet with clients, I generally start out with an 80/20 approach to investing. With 80% being the Foundation of your portfolio and 20% being the Opportunity portion of your portfolio.

These percentages can change and fluctuate depending on many factors – like your age, time horizon to retirement, risk tolerance and financial objectives – but it’s a good starting point. Let’s look at this a little closer.

The Foundation (80%)

The foundation of a portfolio is generally made up of stable, consistent investments that are lower risk in nature. The foundation is an anchor that provides a sense of stability and direction for a portfolio. Investors have a higher comfort level here so they take larger, more significant positions.

When I meet with a new client, the foundation portion of their portfolio may be higher than an 80% allocation if they are older or already in retirement – and it might be less than 80% if they are younger and have more time for growth.

The Opportunity (20%)

The opportunity portion of a portfolio can be more aggressive and can take on higher risk for potentially higher returns. The allocation to the opportunity portion of your portfolio can also fluctuate depending on some of the factors mentioned above.

The “opportunity” is also where I come in – with higher risk/higher reward investment offerings found in Canada’s Exempt Market – and I am happy to tell you more anytime you like!

I really appreciate you reading my post and if you would like to talk further, with no obligation, please contact me today.

Shannon Pineau

Exempt Market Dealing Representative

E: spineau@sentinelgroup.ca

C: 403-872-4010

RRSP’s, TFSA’s, RESP’s, RIF’s, LIRA’s and LIF’s.

RRSP’s, TFSA’s, RESP’s, RIF’s, LIRA’s and LIF’s.