Almost everyone, at some point in time, wants to make higher returns on their investments.

The Usual Suspects

For most average or “eligible” investors, investing generally involves one or more of the following:

• Setting up a RRSP or TFSA account at a bank and investing in mutual funds

• Investing in stocks through a broker

• Setting up a discount trading account and buying and selling your own stocks

• Having a pension at work

• Having a RRSP savings program through work

There is nothing wrong with any of these strategies. They all have pros and cons but ultimately, they are helping you save money towards your goal of a great retirement. That is excellent in my books.

With employer plans, they generally hold the reins and their goal is to do well for you, so you can likely just sit back and let that happen. For personal registered accounts, you have a lot of choices for what you can invest in and generally, at some point in time, investors go looking for higher returns if they are not achieving the results they are hoping for with mainstream investment products.

Starting The Search

When you start looking for higher returns on your money – and by higher returns, I generally mean in the 7% + range – there are all kinds of different options that you can pursue. Things like:

• Stock related opportunities like day-trading, options, futures, penny stocks etc. There is nothing wrong with this it just takes time to learn about and more often than not, novice investors lose money based on emotion or speculations that don’t pan out.

• Investment real estate. I really like this strategy because I think it’s an excellent one that can generate some great wealth over time. There is a big learning curve here though and being a landlord comes with challenges so there is a lot to consider. A sound strategy though if you can take the time to learn.

• Investments in real estate projects found in other countries. There is a lot of opportunity to be found in some of these places, but things can change in a hurry as regulation can be sparse and plans can be difficult to execute.

• Investing with close family, friends or business associates. This can often work out well for accredited investors that are in the know and have larger sums to invest in sound projects. For the average investor though, investing with a smaller player, these often do not go as planned. Rather than the double digit returns that were promised, there are often strained relations instead.

• Multi-level marketing. This usually works out well for the person at the top and the super social. For most people though, it’s hard to make it off the bottom rung and easy to alienate friends and family.

• Get rich quicker scenarios. These come in all shapes and sizes and are always lurking out there for anyone that is searching out ways to make more money. Investors always need to be wary – particularly if something seems too good to be true.

So then what should you invest in that can possibly give you higher returns?

In my opinion – you should look straight to Canada’s Exempt Market and here are the reasons why:

In my opinion – you should look straight to Canada’s Exempt Market and here are the reasons why:

• From a risk reward perspective – it is higher risk and that’s why the prospective returns are so much higher. But here, those risks are very transparent and well explained.

• It’s well regulated and within a safe country that takes its regulations very seriously. To learn more about this and how the market has evolved through years to get to this point – click here.

• In order to offer an investment to clients, issuers have to be accepted by an Exempt Market Dealer. The EMD conducts a rigorous diligence process on the issuer to ensure they are a strong company with a sound plan and a great likelihood of success.

• Issuers that I have offered in the past that have paid out their investors have averaged approximately 8-10% annual return over the life of the investment.

• I am here for you. I’ve worked in the private investment markets since 2007 – I will make sure you understand everything there is to know about the Exempt Market and then help you decide if it is the right fit for you.

But is it Guaranteed?

So with all of these benefits – there must be some guarantee of success right?

NO!

There is absolutely no guarantee. It is a higher risk market and even with all of these safeguards, things can and do go wrong and investors can definitely lose money. It’s important to discuss all of this in the beginning to ensure that the Exempt Market is a good fit and also ensure you allocate the proper amount there.

On the other side of the coin though (and the reason investors continue to invest in the private markets), if you are well diversified across a few quality issuers, there is excellent opportunity for you to achieve the returns you are searching for. When we meet in the future, we’ll look at issuer results to date which will help to illustrate all of this for you.

On the other side of the coin though (and the reason investors continue to invest in the private markets), if you are well diversified across a few quality issuers, there is excellent opportunity for you to achieve the returns you are searching for. When we meet in the future, we’ll look at issuer results to date which will help to illustrate all of this for you.

There you have it. There are a lot of options out there to try and make higher returns on your investment but if you are looking for one of the most regulated, easiest to understand and safest (in a high risk space) places, along with a Dealing Rep that will help you every step of the way – you should definitely consider the Exempt Market.

I really appreciate you reading my post! If you would like to talk further, with no obligation, please contact me today.

Shannon Pineau

Exempt Market Dealing Representative

E: spineau@sentinelgroup.ca

C: 403-872-4010

Then the early 2000’s hit and private investing – particularly in B.C. and Alberta – went retail!

Then the early 2000’s hit and private investing – particularly in B.C. and Alberta – went retail!

Hello, I’m Shannon Pineau…

Hello, I’m Shannon Pineau…

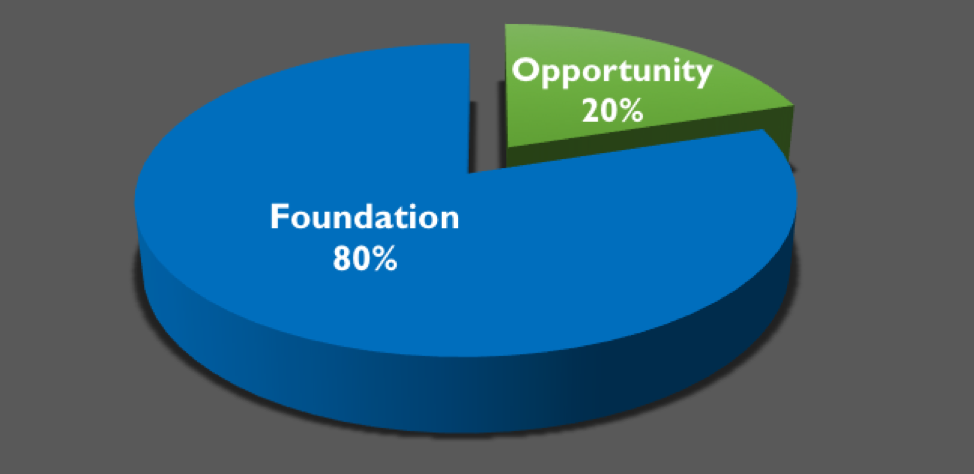

When I first meet with clients, I generally start out with an 80/20 approach to investing. With 80% being the Foundation of your portfolio and 20% being the Opportunity portion of your portfolio.

When I first meet with clients, I generally start out with an 80/20 approach to investing. With 80% being the Foundation of your portfolio and 20% being the Opportunity portion of your portfolio.